Credit utilization ratio is the lifeblood of your financial situation.

Whether you are a credit card holder, loan borrower, or business owner, understanding, analyzing, and increasing your credit utilization ratio all play a significant role in building positive financial habits and a more stable economic future.

To boost your credit score, you need to handle credit responsibly without overspending—but what’s the average ratio necessary to maintain? What goals should you aim for to reduce your credit utilization ratio?

It all depends on your credit limit, credit card balances, and your relationship with past lenders. Typically, a ratio below 30% is considered a good credit utilization ratio.

The lower your credit utilization, the more likely you are to attract lenders and access more credit that you can afford to pay back. A higher credit utilization ratio, on the other hand, is a sign of financial trouble and signals to lenders that you are overly reliant on credit.

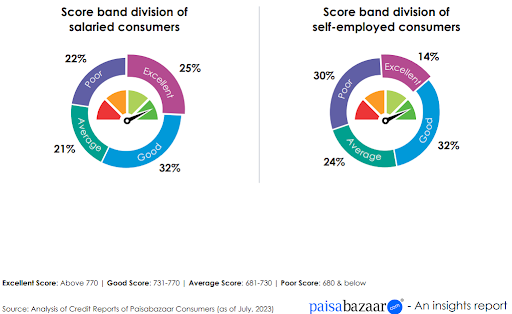

According to a study revealed by Paisa Bazaar, over 25% of salaried consumers have an excellent credit score of 770 and above; above, we found only 14% of self-employed consumers with that strong credit profile.

Why Does Credit Utilization Ratio Matter?

Credit utilization ratio is one of the most important aspects of measuring the revolving credit you’ve used versus the amount available to you. It helps determine your eligibility to apply for new credit while also preventing overspending that could hurt your credit score.

You use credit to make purchases, pay outstanding bills, and manage monthly expenses, whether through a credit card, a loan, or a business credit line. Essentially, you rely on credit with the expectation that you’ll maintain financial stability and improve your creditworthiness over time.

How will you know if you’re handling credit wisely? The solution is to look for the following signs that you’re managing your credit responsibly. Let’s know about these signs:

- Your credit score reflects more than just your credit accounts, but if your score is dropping, you can bet you have a credit score that scares lenders.

- The next best indicator is how responsibly you’re paying interest on your purchases. Don’t spend more than you can afford.

- Having a good credit utilization ratio also shows that you’re handling credit wisely without maxing out your limits. A credit utilization ratio below 30% is generally preferred by lenders.

If your credit utilization ratio is high, try to estimate your spending habits and how much you spend on your credit cards each month. You can lower your utilization ratio by decreasing the balances available to you and increasing the credit limits in your credit reports.

But, if you think maintaining your credit utilization ratio is too much to work on, you may end up hurting your credit scores and have more chances of getting loans with higher interest rates.

We recommend you keep monitoring how much credit you’re using versus how much is available., If you don’t make a habit of doing this, then it’ll be harder—or even impossible—to improve your financial profile.

Which is why your credit utilization ratio matters:

Track Your Credit Account Balances

A good rule of thumb is to keep track of your credit account balances and know their limits. To do this, you can set up automated alerts with your bank to stay notified or try to use your credit cards for necessary purchases only.

Increase Your Credit Limit

You can improve your credit utilization ratio just by increasing your credit limit. You can do this either by applying for a new credit card, to increase your available credit without increasing your spending. A higher credit limit can help you make an unexpected big purchase and can help improve your credit score.

Avoid Missing Credit Card Payments

A late credit card payment can negatively affect your credit history. So, it’s important to make sure that your outstanding payments are always on time. Setting up scheduled or future-dated payments through your bank will help. By regularly monitoring your credit card dues and making frequent payments every month, you’ll increase your chances of getting approved for future loans and maintaining a strong credit report.

Keep Old Credit Cards

Keeping your oldest or unused credit card accounts is a smart way to maintain a lower credit utilization ratio. You should think twice before closing old accounts because canceling has a bigger impact on your credit history and could trigger your credit utilization ratio.

You need to think strategically if you wish to apply for a new credit card because if you aren’t able to manage it responsibly, there are higher chances that you might increase your credit utilization ratio, which is not good.

Calculate Your Credit Utilization Ratio

To calculate your credit utilization ratio:

- Sum up all of your outstanding credit balances.

- Divide it by the total available credit limit

- Multiply by 100 to get a percentage

Suppose you have Rs. 2000 in outstanding credit card balances and a total credit card limit of Rs. 10,000,

your credit utilization ratio would be: (Rs. 2000/Rs. 10,000) x 100 = 20%

So, in this case, your ratio would be 20%, which is good.

That’s below the recommended 30%, which could help increase your credit score.

But if your credit utilization ratio is 40%, how will you bring it down? Here’s how to do it:

- Increase your credit limit: If your total limit rises to ₹14,000, your utilization drops to 14.2% without paying anything extra.

- Pay down your balance: Bringing your outstanding balances down will help you keep within the ideal ratio.

- Spread out spending: Using multiple credit cards responsibly can prevent having a high utilization ratio.

Bottom Line

The credit utilization ratio plays an important role in maintaining a healthy credit profile. It tells you how much of your available credit you’re using, which directly impacts your credit score, loan approvals, and other financial factors.

Improving your credit utilization ratio isn’t a very difficult task. You just have to use simple ways like keeping your balances low, increasing your credit limit, and making timely payments, which may help you maintain a favorable ratio.

Remember, responsible credit usage is all about handling credit balances responsibly. Keep your spending in check, pay off debts strategically, and monitor your credit regularly to ensure long-term financial stability.