We offer expert legal dispute assistance to help you challenge and resolve inaccurate credit report entries. Our team ensures every claim is supported, compliant, and in your best financial interest.

get your loan approved

Fix Your Credit Report With Experts You Can Trust

Whether it’s a personal, housing, or business loan, our proven credit repair solutions ensure you’re back on track – fast and hassle-free.

Trusted by all major bureaus

Trusted by all major bureaus, Credit Bridge Advisors delivers reliable credit solutions backed by verified industry partnerships.

10+ Years of Experience with over 5000 Clients that trust us.

Request a Callback

98% Success Rate

Our proven strategies deliver score boosts in just 90 days with a remarkable 98% success rate across all clients.

End-to-End Journey

We support you from identifying credit errors through disputes and all the way to loan approval, providing a complete solution.

Client Portal

Access our exclusive client portal to track your dispute progress and loan applications in real-time, 24/7.

All 4 Bureaus Covered

We handle disputes across all major credit bureaus in India – CIBIL, Equifax, Experian, and CRIF High Mark.

Legal Backup

If disputes aren't resolved, our legal team steps in with RBI-compliant escalation measures to protect your credit rights.

Individual and Commercial

Credit Repair Services

Rebuild credit scores, resolve inaccuracies, and unlock growth opportunities with our trusted solutions.

Boost your financial health with our Individual Credit Repair Services tailored for personal credit challenges.

We help you correct errors, improve your credit score, and regain control of your financial future.

Our Business Credit Repair Services help improve your Business credit profile for better financing opportunities.

We resolve inaccuracies, boost creditworthiness, and support long-term financial growth.

Credit Report Analysis & Error Dispute

Get your credit report, identify errors, and dispute inaccuracies to improve your credit score effectively.

Debt Management & Settlement Assistance

Reduce financial stress with expert guidance on debt repayment, restructuring, and negotiating settlements for better credit health.

Credit Score Improvement Strategy

Receive a personalized action plan to boost your credit score with better credit utilization, timely payments, and strategic financial habits.

Credit Monitoring & Advisory Support

Stay updated with real-time credit monitoring, alerts, and expert advice to maintain a strong credit profile and avoid future risks.

Business Credit Report Analysis & Correction

Identify errors, discrepancies, and negative remarks in your business credit report and dispute them for a stronger financial profile.

Debt Restructuring & Vendor Negotiation

Manage outstanding debts with expert guidance on restructuring, settlement negotiations, and improving lender relationships for better credit terms.

Credit Score Enhancement Strategies

Get a tailored roadmap to improve your business credit score by optimizing credit utilization, payment history, and financial structuring.

Business Credit Monitoring & Advisory

Receive ongoing credit monitoring, alerts on profile changes, and expert strategies to maintain and strengthen your business credit score.

Credit Rating Assessment & Analysis

Get a comprehensive review of your business credit rating, identify risk factors, and receive expert insights to strengthen your financial standing.

Credit Rating Agency Liaison & Support

We assist in preparing and presenting financial documents to credit rating agencies, ensuring accurate evaluation and better rating outcomes.

Credit Rating Improvement Strategies

Enhance your creditworthiness with tailored strategies, including debt optimization, timely payments, and financial restructuring.

Ongoing Credit Monitoring & Risk Management

Stay ahead with real-time credit monitoring, risk assessment, and proactive solutions to maintain a strong and stable credit rating.

Customized Credit Builder Program

Get access to secured credit cards and targeted financial advice to rebuild credit scores effectively. Get access to secured credit cards and targeted

Get the Case Study

Testimonial for Personal Credit Report

I was struggling with a low credit score, which was holding me back from achieving my financial goals. Thanks to the expert guidance and personalized approach, my score improved by over 150 points within a few months!

Mr Pavan

Architect / Interior Designer

Our Process, How it Works

Our approach is straightforward and open. We start with a free credit consultation and then customize repair plans. We contest mistakes and help you create a better credit profile every step of the way.

Schedule a Free Consultation

Talk to our credit experts and understand the steps

Credit Assessment

Receive a detailed breakdown of your credit report issues.

Customized Plan Implementation

Let us work on your credit challenges while you track progress.

Loan Approval

Enjoy a hassle-free loan application process with a healthier credit profile.

Uncover the Methodical Process Behind Our Credit Repair System Designed

Built on Integrity, Transparency, and Innovation

What sets us apart

Transparency First

We ensure complete honesty, clarity, and openness in every step of your credit journey.

Ethical Solutions

Our credit repair strategies follow ethical, legal, and responsible financial practices.

Innovation

We use data-driven insights and cutting-edge solutions to optimize your credit and financial growth.

What our customers say

Credit Bridge Advisors turned my loan rejection into approval within weeks! Their process was transparent, and the results were better than I expected

Rajesh Kumar

Business Owner

Credit Bridge Advisors turned my loan rejection into approval within weeks! Their process was transparent, and the results were better than I expected

Asha Sharma

IT Professional

Watch our customer stories →

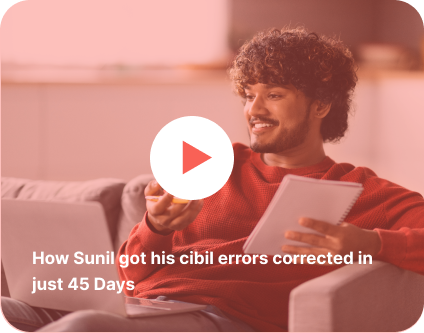

Legal Dispute Assistance

Legal Notices

Formal communications to banks and bureaus requiring action within legal timeframes

RTI Filings

Right to Information applications to uncover documentation and policies affecting your credit

Official Representation

Expert advocacy with RBI Ombudsman and Consumer Courts when needed

Our Legal Dispute Resolution Process

01

Case Assessment

Our legal team evaluates your case, collects evidence, and determines the best course of action.

02

Formal Escalation

We issue legal notices, file RTI applications, and communicate with relevant authorities.

03

Resolution & Verification

We secure corrections across all bureaus and verify your updated credit reports.

Vikram S., Pune

"Kenstone Credit helped me remove a ₹5 lakh default wrongly listed by my bank for 2 years. After their legal team stepped in, it was removed in 30 days!"

95%

Disputes resolved legally

Ready to Transform Your Credit?

Take the first step toward financial freedom with a free consultation and credit assessment.

Got questions?

we’ve got answers

Got credit concerns? We’ve got answers. Whether it’s fixing your score, removing errors, or securing a loan, we make it simple.

Have More Questions?

Is it really possible to fix credit issues?

Yes! We’ve helped thousands of individuals and businesses achieve loan approvals by addressing both technical and genuine issues on their reports.

Can you fix my credit without paying the bank?

Yes, we can help improve your credit by disputing inaccurate or outdated information on your credit report. However, valid debts still need to be resolved directly with the bank or creditor unless they agree to negotiate, settle, or remove the entry.

Why should I trust Credit Bridge Advisors?

Credit Bridge Advisors is trusted by major credit bureaus and backed by a team of experienced professionals. We offer transparent, compliant, and results-driven credit repair solutions tailored to your unique financial needs.

Your Trusted Credit Repair Partner

Integrity. Transparency. Results You Can Count On